By Admin Bench R. Milanio

Imagine how simple it is to shop for groceries. You see an item on the shelf – its price tag visible for everyone to see – so, you know how much money to spend for other needs. You take and place the item in your pushcart. Later, once you’ve completed your grocery list, you have these items punched. It is only then that you find out there are other charges, so that you can fully “own” your groceries. Sounds problematic, right?

When it comes to buying property, it is important to know that there are transaction costs for buying a house and lot or a condo.

Apart from the actual base price of the property, there are closing costs necessary to complete the transaction, which then legitimizes the transfer of rights to the property. From both ends, the buyer and seller will have to pay particular fees, such as taxes, to ensure that the purchase was done in good faith and executed in a legal manner.

What Fees Do I Need to Pay When Buying a House and Lot ? Or a Condominium?

Since the completion of a property transaction is made official through documented paperwork, it is the transferal of ownership that formalizes the deal. This means that outside of the property’s actual price tag, there are costs that one has to shoulder so that the house or property is legally theirs. Listed below are the typical transaction costs in real estate:

Transfer Tax – This refers to the fee that the buyer has to pay for the complete transfer of the property’s ownership. Usually, the transfer tax is paid to the city where the property is located. Rates vary from city to city, but they typically range around 0.50 to 0.75 percent.

Title Registration Fee – This refers to the fee that the buyer has to pay for the issuance of a new title with his or her name certifying the change in ownership. This fee is rated around a percent of the property price.

Notary Fee – Payment of these is negotiable and are generally around 1 to 2 percent of the property value.

Documentary Stamp Tax – Paid by the seller to the Bureau of Internal Revenue (BIR), this refers to the fee for the agency evidencing the transaction as an agreement between all parties involved. The cost is at 1.5 percent, or higher, levied on the property’s selling price or fair market value.

Capital Gains Tax – Paid by the seller to the BIR as well, this refers to another form of transaction tax that considers real estate properties as capital assets. This is levied at 6 percent of the property’s gross selling price or fair market value, whichever is higher.

Real Estate Agent’s Fee – Paid by the seller to the Real Estate Agent or Broker, this serves as commission based on an agreed percentage of the gross selling price of the property. Often, these fees average at around 3 to 5 percent.

How Much is the Transfer Fee When Buying a House

Outside the property’s selling price, if we were to total all the fees necessary to complete a sale, we’ll probably yield a total of 4.5 to 16.25 percent.

The costs paid by the buyer should come to around 1.5 to 3.75 percent of the property’s price tag. The costs paid by the seller, meanwhile, should range between averages of 3 and 12.5 percent – depending on agreements made with the real estate agent.

Knowing these things should prove helpful, especially if one were to engage in property transactions. Apart from knowing these fees, it will also be useful to familiarize oneself.

1 lighting

1 lighting

NO HIDDEN CHARGES

NO HIDDEN CHARGES

Feel Free to send me a Message or kung may mga katanungan po, or referrals and concerns. You may also reach me at my contact details below. Thanks!

Feel Free to send me a Message or kung may mga katanungan po, or referrals and concerns. You may also reach me at my contact details below. Thanks!

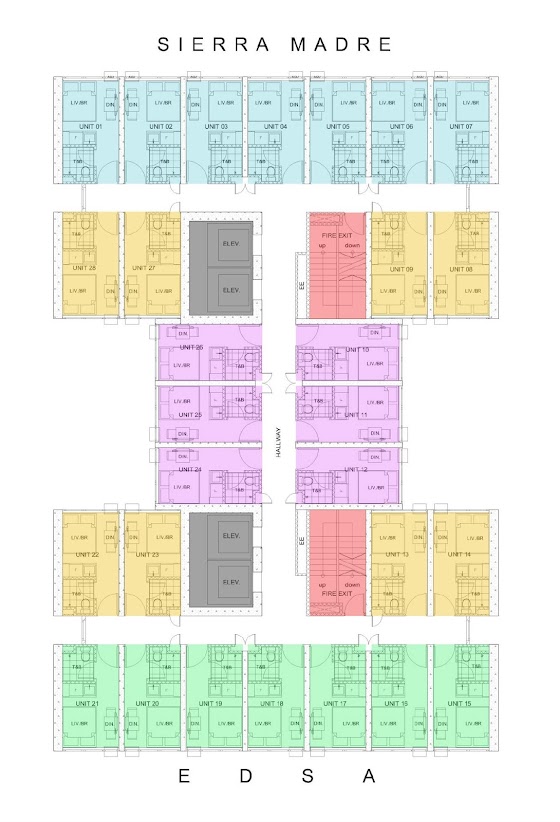

STUDIO TYPE

STUDIO TYPE